travel nurse state taxes

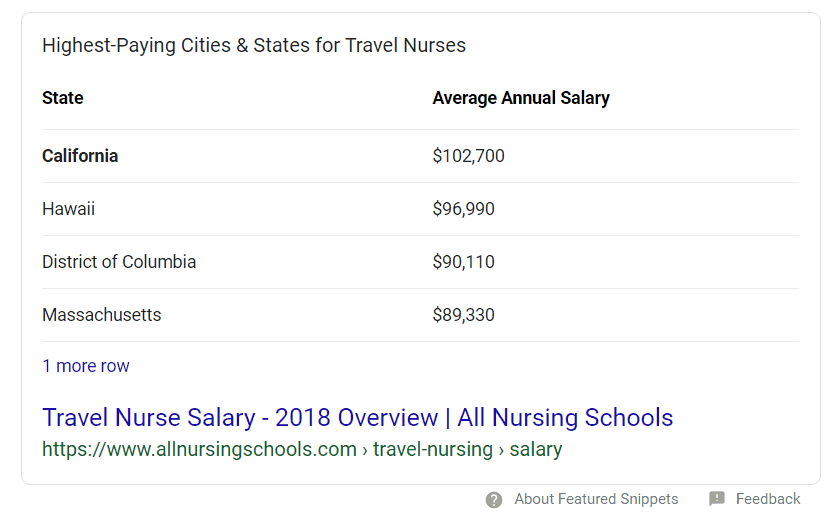

MyIdea Travel Nurse State Taxes. This is due largely to the fact that levels of tax-free compensation vary so greatly.

U S Travel Nurses Are Being Offered As Much As 8 000 A Week Bnn Bloomberg

Travel Nurse Tax Deduction 1.

. How many states have state income tax. Be sure to carefully read and file the tax return for your tax home state as that is where you will apply for those credits. MyIdea Travel Nurse Taxes In California.

Also nurses are free to go anywhere in their breaks. There are so many benefits of being a travel nurse. If I am a resident of any of these states or the USVI I am not exempt from paying state taxes in the states that I work.

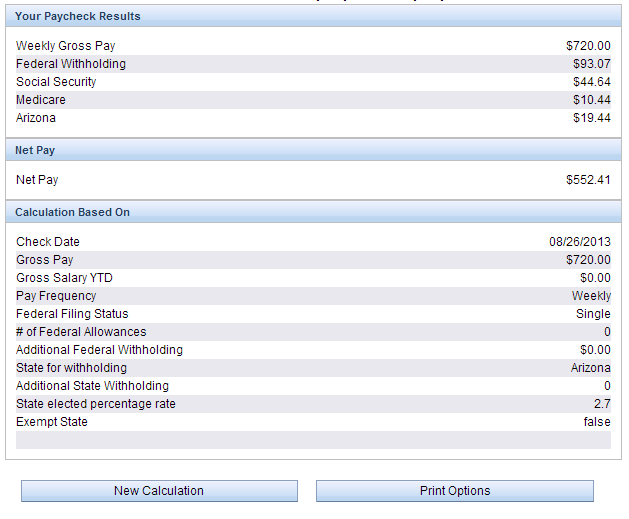

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. One frequent mistake traveling nurses make is not applying for state income tax credits on tax returns filed in your tax home state. Here is an example of a typical pay package.

1 A tax home is your main area not state of work. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year. It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state.

Joseph conte is a cpa based in coral springs fl. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. Crisis Contracts and Travel Nurse Tax Changes.

But I Didnt Work Thereand similar comments about travel nurse taxes and state tax returns. I could spend a long time on this but here is the 3-sentence definition. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses.

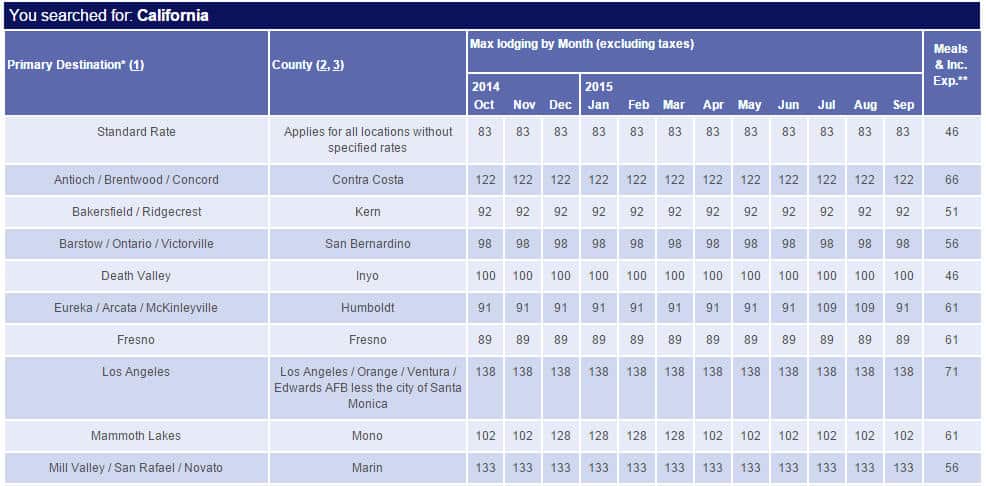

State returns which are often the more complex aspect of filing taxes for travel nurses are subject to different due dates. 250 per week for meals and incidentals non-taxable. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home.

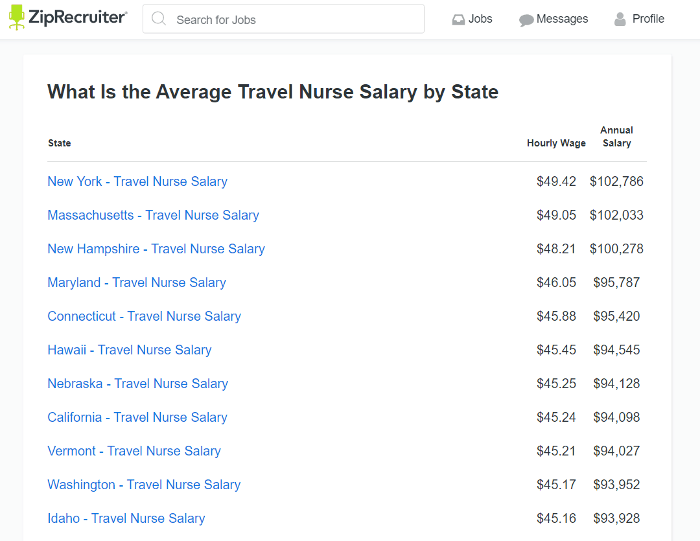

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. If you are working in more than one state throughout the year you. Presently Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming wont tax your travel nurse salary.

You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. The staffing firms finance department will be able to provide you with a clear breakdown that you can use for the filing of your travel nurse taxes. 20 per hour taxable base rate that is reported to the IRS.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. This takes a depth of. Many states are still expecting residents to file by April 15th and still assessing penalties for those who file late.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Lets first discuss why filing taxes as a travel nurse can be a little more complicated than the norm. In previous articles I have pointed out the difference between a permanent residence and a tax residence.

At the same time the work state will tax the income earned there. States have a state income tax but alaska florida nevada new hampshire south dakota tennessee texas washington and wyoming dont. Travel nurse tax tips.

The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs. 41 states have income tax. Tax-Free Stipends for Housing Meals Incidentals.

If a travel nurse is not qualified to receive tax-free stipends the rate will be the similar 40-80hour but taxes will apply to the whole amount. I live in Florida and receive a retirement pension form the military. Travel nurse taxes are due on April 15th just like other individual income tax returns.

Travel nursing and taxes can seem tricky so if you feel uncomfortable go to a professional to help answer all of your questions. Be subject to Ca. The following states and jurisdictions do not have an income tax.

Calculating net pay is an important step in comparing competing travel nursing pay packages and ultimately deciding whether or not to accept a particular travel nursing job. Also nurses are free to go anywhere in their breaks. The importance of net pay is relatively unique to travel nursing.

Here are some categories of travel nurse tax deductions to be aware of. Not only do you get to travel the world now there are tax deductions that you can take advantage of. Another common mistake is not maintaining a clear tax home.

My question is would ONLY the income earned in Ca. You will still make more money than the average staff nurse in most states. This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually.

This is the most common Tax Questions of Travel Nurses we receive all year. Travel Nurse Taxes In California This is 15 higher 11671 than the average travel nurse salary in the united states. And how this distinction is the main source of confusion among travelers recruiters and staffing agencies who try to determine whether travel reimbursements.

The USA News Source US. Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one. Not just at tax time.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Deductions Make It Possible to Earn More Money. Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and the District of Columbia for nonresidents.

State income taxes or would my retirement pe. Hi there I am considering travel nursing to California but I do not know how the state income tax works there.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Pro Home Facebook

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To Make The Most Money As A Travel Nurse

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Travel Nurse Benefits Should You Be Receiving Top Class Actions

Trusted Guide To Travel Nurse Taxes Trusted Health

Travel Nursing Is Great But Don T Forget Your Tax Home R Nursing

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Pin On Everything Travel Nursing

6 Things Travel Nurses Should Know About Gsa Rates

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog